The next generation of real estate investors will be risk averse, long-term planners and will use technology for all aspects of their investment lifecycle.

These investors will be from the millennial generation. This past year marked the first time that millennials became the largest generation in the Canadian workforce. According to Statistics Canada, millennials account for 36.8 per cent of the workforce, with Gen X at 33.9 per cent, and Baby Boomers at 31.1 per cent.

This generation is now as large or larger than the boomer generation for total population. This level of buying power will have major implications to the type of financial products that live or die in the future.

According to the MFS Investing Sentiment Insights survey, many millennials appear to be risk averse, long-term thinkers, with a mixed view on investing. Despite dismal savings options, millennials hold more cash than any generation before them since the post-war generation.

This makes sense. The financial collapse had a major toll on their early careers and entrance into the workforce. There is an inherent distrust and pessimism associated with the stock market. The markets are viewed as an insiders-only type of game, but the tide appears to be shifting as more new investors see the benefits of options, such as ETFs.

The millennials can become a savvy group of investors with the help of technology and an early start to their investing strategy. On average they have started their investing earlier than the Gen-Xers, at age 20 compared to age 27. This has been spurred by greater access to information and streamlined access to the markets online.

Technology is the millennial calling card and already there have been major advancements in real estate technology.

Just look at how Airbnb has helped solve the short-term vacancy problem many landlords face. They’re not the only ones breaking into this marketing either. Real estate technology start-up funding has grown over 10-times since 2010 and this still only accounts for two per cent of funding across all industries.

Even major tech companies, such as Google and Amazon, have taken notice and have started to enter into the services listing industry to help homeowners and landlords.

So far millennials don’t appear to be pushing for flips and quick cash but instead are focused on stable buy-and-hold opportunities. The next generation of real estate investors wants a long-term investment that will provide stable returns in exchange for low levels of risk.

Article courtesy of Canadian Real Estate Wealth

INVESTORS FREEBIES

- Get a FREE list of DISTRESS SALES/BANK FORECLOSURES here

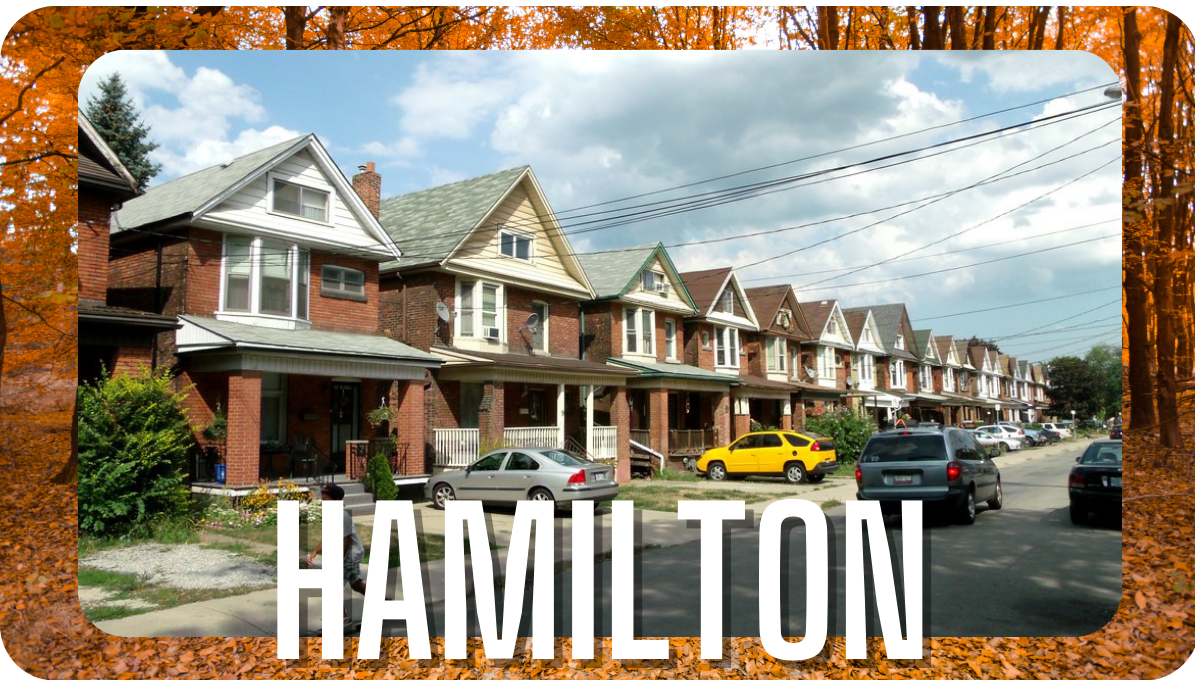

- Get a FREE list of Hot Properties in Hamilton for FREE

- 10 Reasons to Invest in Hamilton

- Invest in Hamilton, the location advantage